Day 93: Dunleavy changes course and proposes a sales tax

After years of status quo budgets and outlandish plans to raise revenue, Dunleavy is finally backing some new revenue, but there are big questions about its details.

Good afternoon, Alaska! It’s day 93.

In this edition: After years of status quo budgets, demands that any and all taxes be sent to a vote of the people and generally outlandish pitches about raising new revenue, Gov. Mike Dunleavy is now pushing a statewide sales tax. The reversal came in private meetings with legislators on Tuesday, and concrete details are scarce. Still, it’s already raising concerns about fairness and just far it would move the dial on the state’s financial picture, a point highlighted by the Senate Finance Committee’s recent work on an update to the PFD. Also, a look at what’s going on up in Fairbanks, where folks are not too thrilled by a mining proposal that would put loads of big trucks onto public roads, requiring costly upgrades they otherwise wouldn’t need. And, finally, the reading list.

Current mood: 🤔

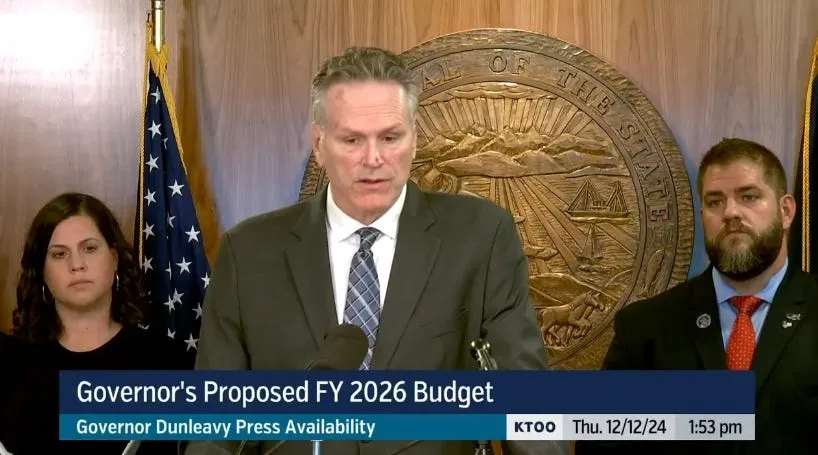

Dunleavy changes course and proposes a sales tax

A day after the House passed an operating budget containing a nearly $600 million deficit, Gov. Mike Dunleavy held private meetings with legislators to pitch them on a statewide sales tax, reportedly conceding Alaska’s financial picture isn’t so hot. It’s a significant reversal for a governor who just last year vetoed legislation increasing the age to buy tobacco products because it contained a tax on tobacco vapes. It appears that he’s also had a change of heart on how involved Alaskans must be.

According to reports by the Anchorage Daily News and the Alaska Beacon, legislators were left with the impression he’s dropped his demand that any and all taxes be first approved by voters, a threat that has loomed large over legislative deliberations.

Unsurprisingly, the governor’s office has been cagey about the details of the sales tax proposal, the meeting and whether the governor has dropped his demand. At the very least, that demand wasn’t mentioned during the meetings.

“That indicates to me willingness to potentially sign or allow to go into law those pieces of legislation without a referendum. So did he say it explicitly? No. Was that the message that I got? Yes,” House Minority Leader Calvin Schrage, I-Anchorage, told the ADN.

It doesn’t appear the governor shared concrete details of his sales tax proposal, and some legislators seemed to have differing ideas of what he was proposing. The big question will be the rate and whether it would allow for any exemptions, specifically for groceries that can cost significantly higher in rural Alaska.

A proposal by Nikiski Republican Rep. Ben Carpenter would implement a sales tax with no exemptions for groceries and would see much of that revenue go out the door in simultaneous cuts to the corporate income tax rate. That plan has been derided by several legislators, who called out the proposal for being a “corporate giveaway” that would significantly impact people living in rural Alaska.

Setting aside the crucial question of fairness in taxation, there’s also the issue of how much a statewide sales tax would generate for the state’s bottom line. Carpenter’s no-exemptions sales tax is estimated to raise about $740 million per year, with about half of that going to pay for his plan to cut corporate income taxes.

The latest figure the Senate Finance Committee put forward as a revenue goal is nearly twice what Carpenter’s sale tax, on its own, would raise.

The Senate Finance Committee is proposing a rewrite to the PFD formula that would set the dividend formula at 25% of the spendable revenue of the Alaska Permanent Fund or about $1,300 annually. It’s an amount that several legislators, including the Senate Finance Committee co-Chair Sen. Bert Stedman, have noted would allow the state to afford to increase school funding, increase its investment in infrastructure and avoid taxes.

Pitched as the groundwork for a larger fiscal plan, it would allow PFD-friendly legislators to grow the dividend if benchmarks for increased revenue and increased savings are met by 2031. But at $1.3 billion in additional revenue and a target of $3.5 billion in the Constitutional Budget Reserve, legislative analysts have conceded that hitting such goals is difficult, if not impossible.

That may be the point.

Stedman and many other centrist Republicans have often questioned the wisdom of raising taxes to fund cash payouts to Alaskans. Backers of that plan say the legislation illustrates the scope and scale of the problems facing the state: Alaska doesn’t have enough stable revenue to maintain a status quo budget, let alone meet the state’s needs in education and infrastructure, while also paying out a large PFD.

Fundamentally, it’s a structural deficit and, as the presentations in the Senate Finance Committee this year have shown, little has truly changed since Dunleavy took office.

Ever since the governor proposed deep and deeply unpopular cuts in his first term, he’s taken a largely passive role in the state’s fiscal plan discussions. Instead, he’s generally proposed status quo budgets that are light on cuts and stymied legislative work on a fiscal plan with a blanket threat to veto anything that voters didn’t first approve. Moreover, his few proposals have generally been outlandish suggestions like legalized gambling and monetizing carbon sequestration.

Carbon sequestration, the act of selling credits for the state not logging trees and injecting carbon into underground storage, has been met with a chilly response from legislators who are skeptical about just every piece of the plan, from the amount of revenue it’d generate to the cost to stand the program up and even the general concept of locking away public lands from development.

Still, the governor’s announcement on Tuesday was seen as a positive, albeit exceptionally late in the process step forward with fewer than 30 days left in the legislative session.

“I’m just hoping that he, in the end, will provide the leadership we need from a governor,” Stevens told the Alaska Beacon.

Stay tuned.

The Alaska Memo by Matt Buxton is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

The Interior’s battle over bridges

I started my career at the Fairbanks Daily News-Miner and will always have a soft spot for the Golden Heart City, but that doesn’t mean I always keep up-to-date with what’s been going on up there.

That’s to say; I’ve been hearing quite a bit of frustration coming out of the Interior for a while now about an ore-hauling plan proposed by Kinross that would put loads of big trucks on the existing roads to move ore from the Manh Choh project near Tok to Fort Knox, a roughly 250-mile trip. There are concerns about the safety of the project to other drivers, the environmental impact and the cost because, after all, it’ll be on public roads that would need costly improvements to handle the industrial traffic.

A citizens group called Advocates for Safe Alaska Highways has formed in opposition to the plan as it currently stands, laying out several concerns mentioned above and highlighting the general lack of publicly available information about the cost and details of the plan. They’re explicitly not anti-mining, as their website explains several times, but argue the concerns could be handled by changes like using single trailers rather than the current plan of doubles or with sections of private roads.

I’ve talked with some of its members, and there’s a lot of frustration that it seems like the whole plan is being fast-tracked by the mining-friendly Dunleavy administration when the benefit to the state isn’t really there as the mine is on private land. The group estimates the bridge and road improvements will cost around $500 million.

Fairbanksan Kuba Grzeda, who writes the very good newsletter Kuba’s Corner, offered the following observation on the current state of the project as the public testimony window for the replacement of bridges over the Johnson, Gerstle and Robertson rivers is nearing a close:

This work would be welcome, except these projects have been fast-tracked to expedite their design and construction to serve the ore-hauling plan proposed by Kinross, likely leading to much higher costs.

Although these bridges are still functional for normal traffic volume and weight, their aging design has rendered them susceptible to increased degradation caused by the proposed heavy and frequent ore haul truck crossings. If not for the Kinross ore haul, the bridges could have followed standard DOT timelines for replacement.

Grzeda has additional information on the bridges, the concerns and the public testimony window in his full post, that you can find here:

Reading list

- It’s been more than two years since Anchorage voters approved taxes for police to start using body-worn cameras, and it still hasn’t happened. A lawsuit says enough’s enough. From Alaska Public: City of Anchorage sued for not having body-worn cameras on police officers

- Former Kenai Peninsula Borough Mayor Charlie Pierce won’t have to personally pay a penny of a nearly quarter-million dollar settlement over a sexual harassment lawsuit launched against him last year. From KDLL: Borough settles Pierce harassment suit

- The state’s backlog in processing public assistance applications isn’t exactly getting better. From the ADN: Alaska Department of Health sued over cash assistance delays for blind, disabled and elderly Alaskans

- Oh, and that comes as the state has to resume Medicaid eligibility reviews, which could mean thousands of Alaskans will lose health care coverage. From the ADN: Q&A: Thousands of Alaskans on Medicaid could lose coverage in the coming months. Here’s what to know.

- And a deeper look at just how poorly Bronson-backed candidates fared in this last election. From The Alaska Current: Anchorage voters reject Bronson-backed candidates by a landslide

The Alaska Memo Newsletter

Join the newsletter to receive the latest updates in your inbox.