Good afternoong, Alaska. It’s the sort of sunny Monday that makes afternoon legislative meetings feel like torture.

In this edition: A shocking—shocking!—well-not-that-shocking report released over the weekend details efforts by an Alaska Permanent Fund trustee (one of the closest allies of Gov. Mike Dunleavy on the Board of Trustees) to steer investments from the state’s golden goose into companies owned by family, friends and business partners. It comes at a time when the Board of Trustees is looking at riskier investments for the state’s golden goose, but given everything, I won’t be holding my breath for any accountability coming their way.

Current mood: 😎

Also: The guessing for the #GavelClassic is open! I had a question about how the winning works. When we’re getting to the end of the session, people will be “on the clock” when their time is next up and out when the session goes past their guessed time. Have the session go out during that window, and you’ll be the winner of… bragging rights! Best of luck!

‘This difficult interaction’

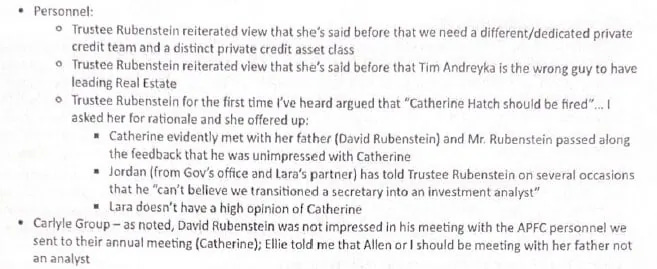

The Alaska Landmine dropped a bombshell report over the weekend, detailing Alaska Permanent Fund Trustee Ellie Rubenstein’s efforts to set up meetings between the fund’s executives and investors in her private equity firm, Manna Tree, and her father, billionaire investor David Rubenstein. The efforts are outlined in a series of emails by APFC leadership that document the efforts—which included an apparent attempt to get an analyst fired after a meeting with her father left him “unimpressed”—and growing discomfort over the ethics of the situation.

“I think the more serious topic and perhaps more uncomfortable to address are Trustee Rubenstein’s conflicts of interest in the private credit space. As we all know she has made dozens of investment manager referrals in her 18 months on the APFC board. Many of these have been in the private credit space, and my team has declined to pursue all of them,” APFC Chief Investment Officer Marcus Frampton wrote to Sebastian Vadakumcherry, chief risk and compliance officer for APFC, in one email.

Throughout the exchanges, APFC staff took meetings skeptically and never reached agreements to make new investments or increase existing ones. David Rubenstein is co-founder of the Carlyle investment firm, which already manages about $800 million of the fund. Per the emails, Frampton relayed to a Carlyle group executive that they already had “a very expansive and robust relationship” with the firm, to which the executive said he didn’t think it was but was interested in taking “expansive and robust.” However, that apparently caused friction between Rubenstein and the lower-level investment analysts tasked with taking on several meetings. That included a meeting between a relatively new analyst and David Rubenstein, who walked away “unimpressed.” Ellie Rubenstein took that to APFC leadership—and apparently the governor’s office—to get the analyst fired.

According to the emails, Allen Waldrop, the corporation’s director of private equity investments, frequently resisted Ellie Rubenstein’s efforts and stood up for the analyst despite apparent misgivings from the governor’s administration.

“Ellie knows [the analyst] and knows that she is an analyst with limited professional experience (which should be obvious because she is an analyst) and arranged the meeting anyway. Stating the obvious, but I would not expect one of the pioneers of the buyout market who is also one of the wealthiest people in the US [David Rubenstein] to be impressed with an analyst with a couple year’s experience. I would not expect him to be impressed with me either,” Waldrop wrote. “Our goal when we meet firms is not to impress them.”

Ellie Rubenstein, who is an Alaska resident (correction: Rubenstein’s investment firm, Manna Tree, is based Outside, but she is a longtime resident of Anchorage), was appointed to the Board of Trustees in 2022 by Gov. Mike Dunleavy. As the governor seems to do with fabulously wealthy and influential people, Ellie Rubenstein appears to have a special level of influence in the governor’s administration. A player in the private equity market, she has argued the fund should lean much more heavily into private equity investments. The Landmine notes that the money in the private equity market is hurting due to rising interest rates, and investors are likely keen on any new pots of money, such as the roughly $80 billion in the Alaska Permanent Fund. Notably, private equity investments were a massive part of Rubenstein’s plan to rocket the Alaska Permanent Fund to $100 billion in a matter of years. The move would have required the fund to borrow massively for the riskier investments, a proposal that was politely laughed out of the room when presented last year, with one calling it a “uniquely bad time” for the fund to make such a bet.

'A uniquely bad time'

The performance of the private equity team has also been a sticking point for Ellie Rubenstein, who has also attempted to shake up the private equity team following disappointing meetings with her business partners. CIO Frampton noted this in the emails obtained by the Landmine:

“A reasonable person might also ask the question of whether she would be more enthusiastic about APFC personnel handling private credit investments has we elected to invest in TCW, Churchill, or Goldman Sachs private credit funds. A reasonable person might wonder if her current position is some sort of retaliation for rebuffing these investment referrals,” Frampton wrote.

He also documented an instance of Ellie Rubenstein relaying that Dunleavy didn’t plan on reappointing Board Chair Ethan Schutt to a second term. Schutt has been one of the board's more measured and risk-averse members, sometimes getting crosswise with Rubenstein and other Dunleavy-allied Trustees.

“Trustee Rubenstein told me that I should know that Chair [Ethan] Schutt will not be reappointed by the Governor when his term is up this June,” Frampton wrote in an email to APFC CEO Deven Mitchell.

“Thanks for keeping us in the loop,” Mitchell wrote back. “I believe you handled this difficult interaction as professionally as possible.”

What’s next

It’s hard to say whether Trustee Rubenstein will be held accountable in this process. She’s insisted that she’s done nothing wrong because she just set up meetings and wasn’t making the investment decisions. The Dunleavy administration appears to have been aware of much of this throughout the process, and there’s been no sign of interest in reining her in. And the Department of Law, under AG Treg Taylor, has demonstrated it can conjure up whatever legal guidance fits the moment.

The Alaska Legislature, specifically the Senate, has been much more willing to wade into the operations of the Alaska Permanent Fund, particularly after the fallout from the Board of Trustees’ politically questionable firing of former CEO Angela Rodell. Then, it was widely speculated—though never concretely proven—that the Dunleavy administration saw Rodell as a roadblock to taking on riskier moves with the fund.

There’s been some talk about changing some of the operations around the fund and increasing legislative oversight. With less than three weeks left on the clock—and a Republican House Majority closely allied to the governor—it’s not likely that anything will pass this session. On the other hand, it’s not expected to win many votes for proposals to increase the fund’s borrowing power or exempt some of its executives from the Open Records Act.

Stay tuned.

I’ll miss the Permanent Fund when it’s gone.