Happy Friday, Alaska! I’ve got some new hardware in my jaw, so a short one this week.

In this edition: After hearing a lot of talk about how Alaska’s current retirement system isn’t working out for public sector employees, the Senate Finance Committee on Thursday got into the real-world numbers and, surprise, it isn’t working. With 17 years under the latest retirement system, a vast majority of employees aren’t keeping pace with what’s needed to have a successful retirement. There’s a small group that is, but they are typically the ones racking up a massive amount of overtime hours. Rep. David Eastman gets a visit. And weekend watching.

Current mood: 🪥

Alaska’s retirement system falls short for most

We’ve heard from employees, employers, unions and lawmakers that the state’s current retirement system for public employees—both state and local—just isn’t working. The combination of the 401(k)-style retirement tier and the state’s lack of Social Security benefits is not only far less generous than the previous tiers, advocates for change argue, but it exposes employees to far greater uncertainty.

Still, any piecemeal attempts to change the plan—like the current proposal that would move public safety employees only over to a defined benefit pension system—has been met with conservative opposition that seems to essentially boil down to them believing public employees don’t deserve to retire with dignity.

The Senate Finance Committee asked the Division of Retirement and Benefits to do a deep dive study into the real-world numbers of where state employees currently stand on the path to their retirement. Sen. Bert Stedman, the co-chair of the Senate Finance Committee, previewed the hearing earlier this week at the Senate Majority’s news conference, saying the findings would “shore up some of the political positions some people have and it may shoot holes in others.”

It sure did.

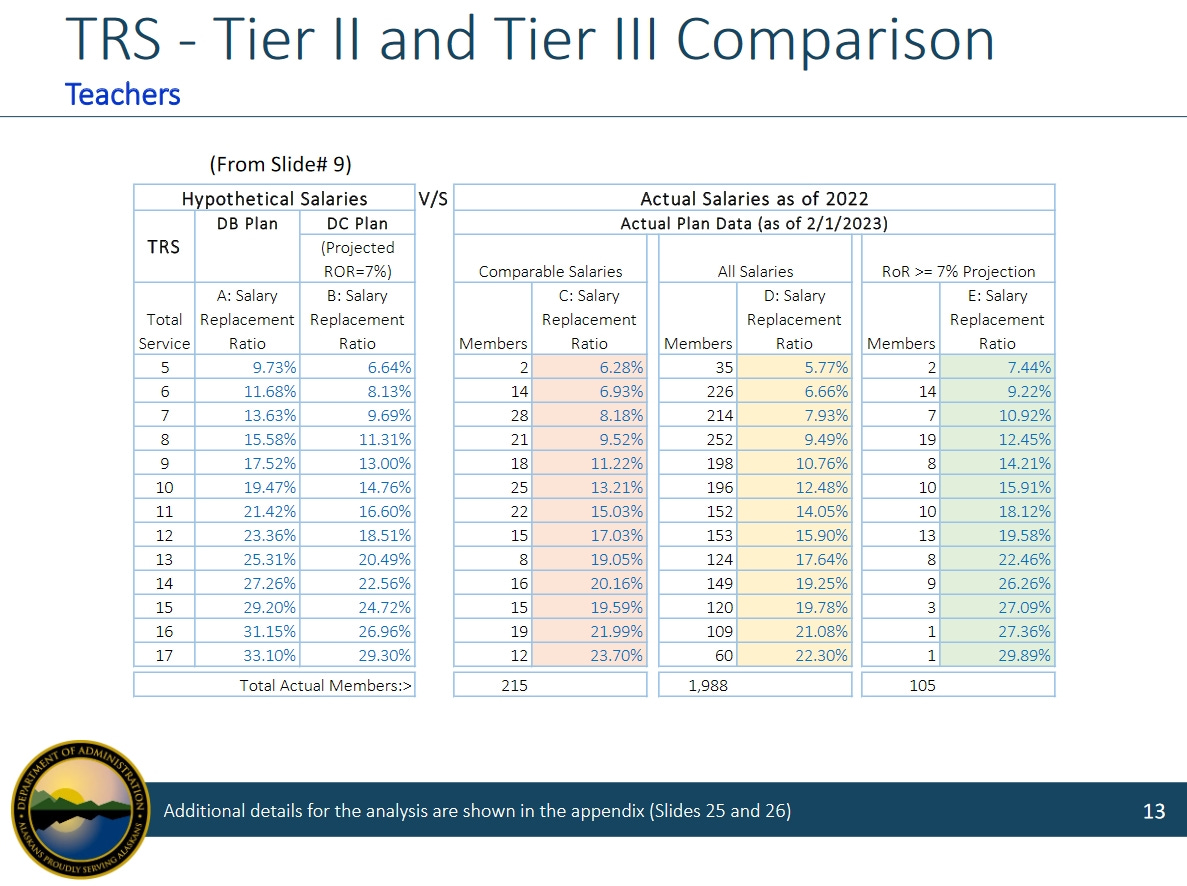

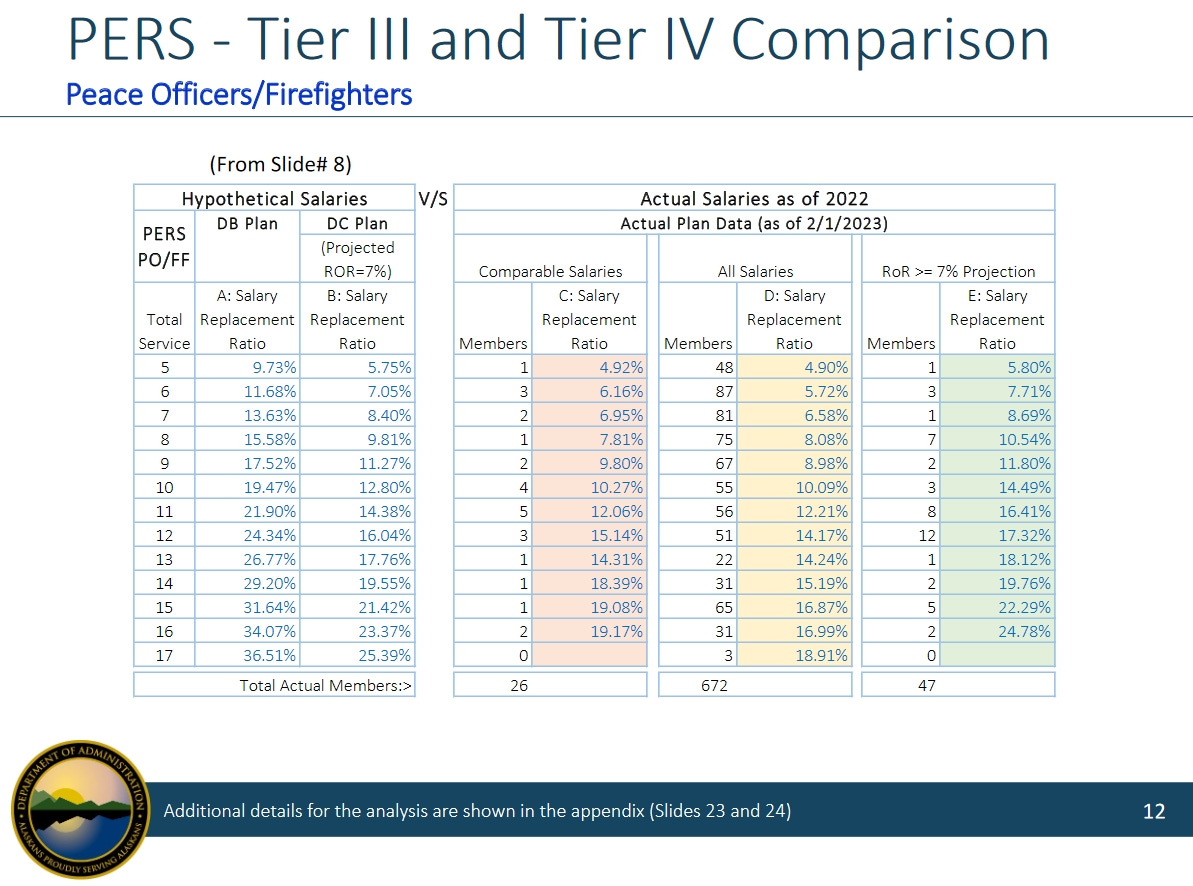

The hearing started out with a look at where public employees under the current tier system should be in a hypothetical scenario with the key figure being what percentage of their final wages they’d maintain into retirement. A 70% wage replacement is the goal, allowing retirees to maintain their lifestyle well into old age. In the hypothetical scenarios, the current tier of employees should be doing about as well if not better than the previous tiers (though, it should be said, that the anticipated wage replacement of the old tier was closer to 60% in most cases).

Things almost didn’t get past that point with Sen. Jesse Kiehl pointing out that pretty much every assumption in those hypotheticals was a little more rosy than a sound financial adviser would suggest. The questioning got to a point where Sen. Stedman interjected, telling Kiehl, basically, to shut it and wait for the good part.

“We don’t really want to wrapped into the comparison of the hypothetical. We did that 17 years ago when we put in this plan. What we’re trying to do is get down to the point where we can actually look at performance,” he said during a back and forth over the targeted salary impact in the hypotheticals. “It’s irrelevant frankly. It’s a hypothetical of a targeted salary to see where it would run. But, again, we want to see the actual results and look for our strengths and weaknesses.”

The assumptions may have been rosy, but the real-world data sure isn’t.

Division of Retirement and Benefits Director Ajay Desai said there’s sizeable gaps between the hypothetical scenario and a vast majority of public sector employees of all categories. For example, where they’d expect teachers to have reached 29.3% wage replacement after 17 years of working, the average is sitting at just 22.3%. It’s a similar story across almost every field with a majority of employees seeing a gap of about 5% or larger between the hypothetical expectations of the current tier and reality.

There was a very small fraction in each field that were ahead of the expectations, but Desai credited that largely to higher earners and people collecting a large amount of overtime hours. The report only found 105 teachers that fell into such a category with literally just one 17-year employee doing so. That sole teacher has 29.89% of their wage replacement collected to the expectation of 29.3%. But what’s particularly notable across all categories, is that none of these overachievers are anywhere close to where they’d be under the previous system. A teacher with 17 years of service under the old pension plan would have been expected to already have accumulated 33.1% of their wage replacement.

Exactly what happens next isn’t entirely clear. Since the plan has only been around for 17 years, we don’t actually know if it’s enough to provide a successful retirement for state employees as Desai argues that the gaps should close at least some over the long-term… as long as the markets behave as expected and employees see 7% growth each year.

Kiehl, who is a proponent of a return to a defined pension, told the Alaska Beacon that he still wasn’t buying the assumptions.

“This is put together by Miss Rose E. Scenario,” Kiehl said, “and it still fails over and over.”

Stedman said the point of the meeting is to put the numbers out into the public for consideration, pledging additional hearings to dig further into the issue.

Follow the thread: Senate Finance gets a look at the real-world performance of Alaska’s retirement system

See also: The hearing and see the presentation

The key charts, explained: I’ve included some of the key charts looking at the real-world experience from the hearing that are, admittedly, quite confusing at first glance. The basic way to navigate these charts is that the two columns on the left show the expectations for the old defined benefit plan and the current defined contribution plan. The three columns on the right show the three different categories of employees found in the study—those who have salaries similar to the assumptions in red, all salaries put together in yellow and the overachievers in green on the right. The left shows the projections, the right three show the real-world experience and how many employees fall into each category.

Teachers

Public safety employees

Non-teacher, non-public safety employees

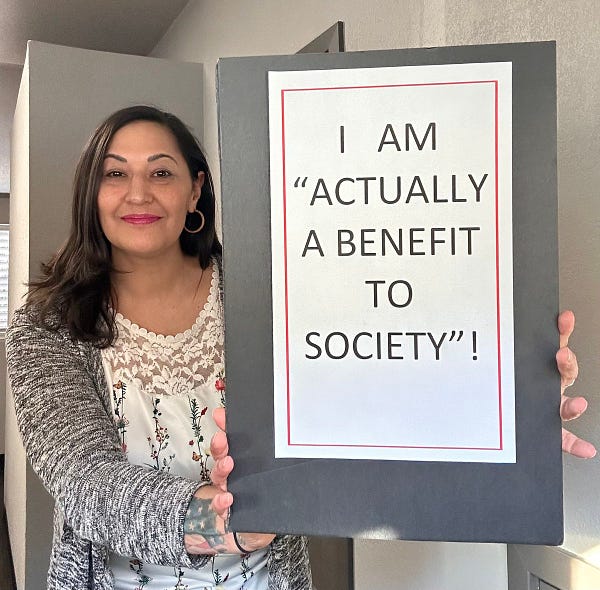

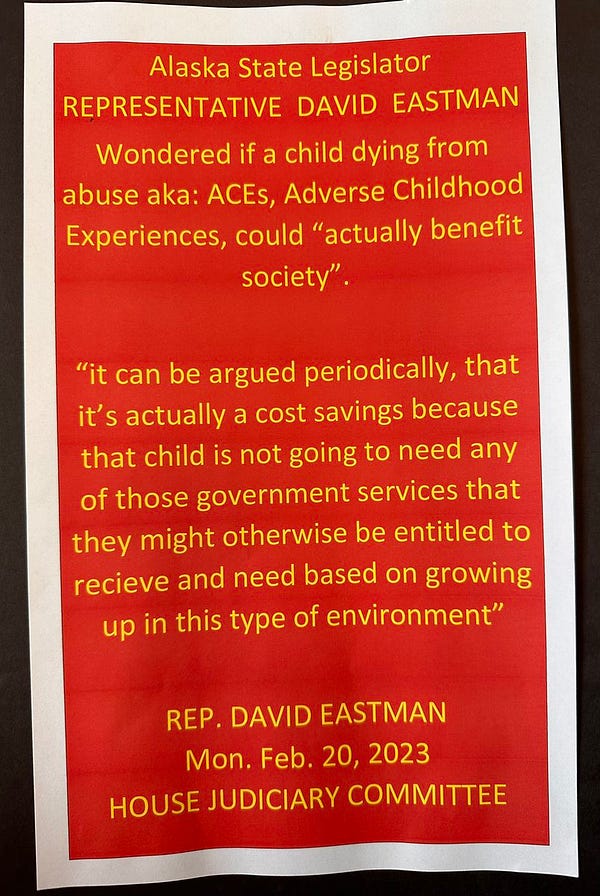

Rep. Eastman gets a visit

Weekend watching

Something silly for this week. I was down visiting family last weekend, and my brother got me to sit down and finally watch some of Netflix’s “I Think You Should Leave.” I wasn’t really all that sold until I saw this sketch:

Have a nice weekend, y’all.